This Queer FinTech Founder Wants Your Money to Work for You, Not Banks

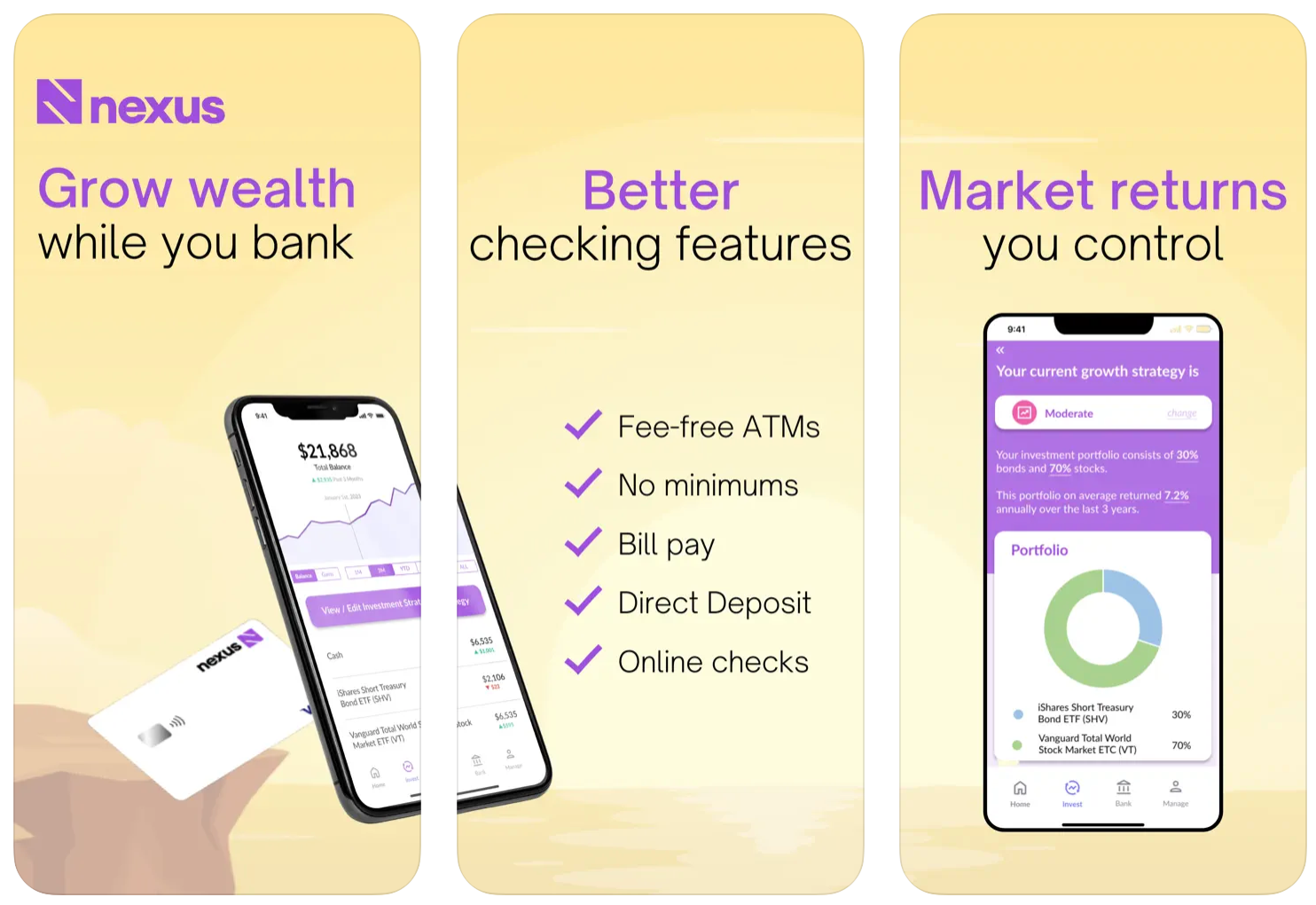

Nexus gives users everything they need from a checking account while keeping the entire balance invested in diversified funds to earn returns.

(This article features affiliate links, meaning we may earn a small commission if you sign up for this product using these links).

Chen-Chen Huo, co-founder of Nexus, was lucky enough to have the value of compound interest drilled into him from an early age. When he turned 18, his parents set him up with a Roth IRA with $1,000. After leaving the account untouched for 12 years, the portfolio is now worth over $6,000.

Growing up as a first generation immigrant in San Francisco, Chen-Chen and his family lived frugally and strategically, fitting a family of six into a 650 sq ft. apartment close to his mom’s research lab. As they grew accustomed to life in America, both of his parents became fascinated with the wealth building mechanisms available stateside. Every lunar new year, Chen-Chen would receive a red envelope with a crisp hundred dollar bill that would be immediately placed into a CD at the credit union down the street.

When the opportunity arose to build a product to help others benefit from the potential of investing, it was a no brainer. Nexus originated from a simple problem: there is way too much money sitting in checking accounts earning returns for banks instead of people. Chen-Chen and his co-founders believe that money should be working for the people that earned it, and built Nexus to democratize investment returns for their users.

How it works: Nexus gives users everything they need from a checking account while keeping the entire balance invested in diversified funds to earn returns.

- Traditional banks take checking dollars and invest to earn returns for themselves - Nexus instead gives the returns to people.

- Users can choose exactly where their money goes, from low-risk treasuries and bonds, to higher risk, higher yield stock funds.

- Users also retain liquidity of their funds. Instead of waiting days for transfers between checking accounts and brokerage accounts, money is provided instantaneously at no cost to the user, whenever it is needed.

Chen-Chen is excited about Nexus because it makes accessible and inclusive the same long-term investing principles taught to him by his parents. According to him, “diversified investing is the healthiest way to build wealth. It’s not gambling, there’s no dopamine rush, but it’s smart, strategic, and works.

"We built Nexus to make it ridiculously easy for people to set their investment strategy and live their lives knowing that their entire wealth is earning and benefiting them, not banks. Diversified funds mitigate risk and have time and time again built wealth for investing aficionados. We want to completely eliminate the barrier to participating in this healthy investment strategy and allow people from all backgrounds to learn about and benefit from investing.”

This rings especially true in the LGBTQ+ community, where it’s still legal in 35 states to deny someone access to credit based on their sexual orientation. As a queer founder, Huo wants investing to be simple and effortless, especially for a community that has faced challenges in so many other areas of personal finance. “Investing and earning returns should be one of the easiest things you do - not something that requires hours of research and intimidation.”

Huo says that building Nexus has been challenging, but his most rewarding experience. “We’ve spent months getting the appropriate licenses, staying compliant with regulatory agencies, and overall making sure that we’re doing everything and thensome to being good faith actors and keeping our users’ best financial interests in mind.” Huo has also faced roadblocks in getting people, sometimes even close friends, to use the product. “For some reason, people freakin’ love their banks, even if they literally get negative value from them. Banks would charge fees, provide 0.01% interest, and have crappy support and UI but people would be reluctant to break an 18 year relationship. Banks are like that toxic ex that you just can’t get over.”

But challenges aside, he’s excited to continue growing and improving the product. “Our users love us and love telling us what to do. The favorite part of my day is being able to listen to customers tell me what they want and for me to honestly say, ‘we can probably build that!’ We have an unique opportunity to build a financial product with the user’s priorities and financial well-being in mind, and I absolutely cherish that.”

Throughout this journey, he’s kept his roots and identity close to the product. Huo realizes the fortune and privilege he’s had to learn from financially savvy parents and wants to make Nexus as accessible and easy to use as possible. “Financial literacy is hard and sometimes overwhelming. We want to get the reputation as a good faith company that is building a people-first product that my parents would be proud of.”

Sign up for Nexus here